The only sure thing is that change is inevitable. And that is exactly what happened in late 2017 to Internal Revenue Code Section 162(m) which limits tax deductions for certain compensation over $1,000,000 paid by publicly-held companies to “covered employees.” Up until late 2017, qualified performance-based compensation (a.k.a. bonus, stock options, long-term incentive, etc.) and commissions were not subject to the $1,000,000 tax deduction limit.

In addition, most payments under nonqualified deferred compensation (NQDC) plans, even payments over the $1M threshold were not subject to the limitations of Section 162(m) because such payments occurred after termination of employment when employees were no longer considered “covered employees” under Section 162(m).

Prior to the change which becomes effective in the 2018 tax year, covered employees included the principal executive officer and next three highest-paid employees, as disclosed in SEC filings. The principal financial officer (read the CFO) was excluded from the definition of a covered employee. Further, status as a covered employee was discretely determined in each taxable year with no carryover of the determination from one year to the next.

As a result of the December 2017 Tax Cuts and Jobs Act, however, Section 162(m) was amended as follows:

- Performance-based compensation and commissions are no longer excluded from the $1M deduction limit. As a result, companies are going to lose deductions on a larger portion of compensation paid to executives.

- The principal executive officer (PEO) and principal financial officer (PFO) at any time during the taxable year are now covered employees. Also included are officers (other than the PEO and PFO) whose total compensation is required to be disclosed to shareholders because they are among the three highest-paid officers.

- Once an individual is considered a covered employee, they are forever considered a covered employee even potentially after death. As a result, companies will have many more covered employees and potential for greater frequency and magnitude of lost deductions.

Exemption: All compensation payments under written binding contracts that were in effect November 2, 2017, and “not modified in any material respect” after that date are exempt and are still deductible.

As such, more compensation will not be deductible AND payments of deferred compensation will be subject to the deduction limitations of Section 162(m) with greater frequency. So what can be done to reduce lost deductions?

Despite its increased susceptibility to being subject to Section 162(m) limitations, using deferred compensation is the best answer. If covered employees can shift compensation from pre to post-retirement, companies may be able to reduce or even in some cases, eliminate lost deductions.

We need to consider an example, but first let’s remember:

- Public companies must disclose deferred compensation for named executive officers (NEOs).

- Balances in deferred compensation plans are at risk of company financial solvency since plans cannot be formally funded for ERISA and tax purposes and plan participants must be unsecured general creditors.

- Companies should highlight the willingness of their NEO’s to subject their currently earned compensation to the risk of loss in the event of financial difficulties.

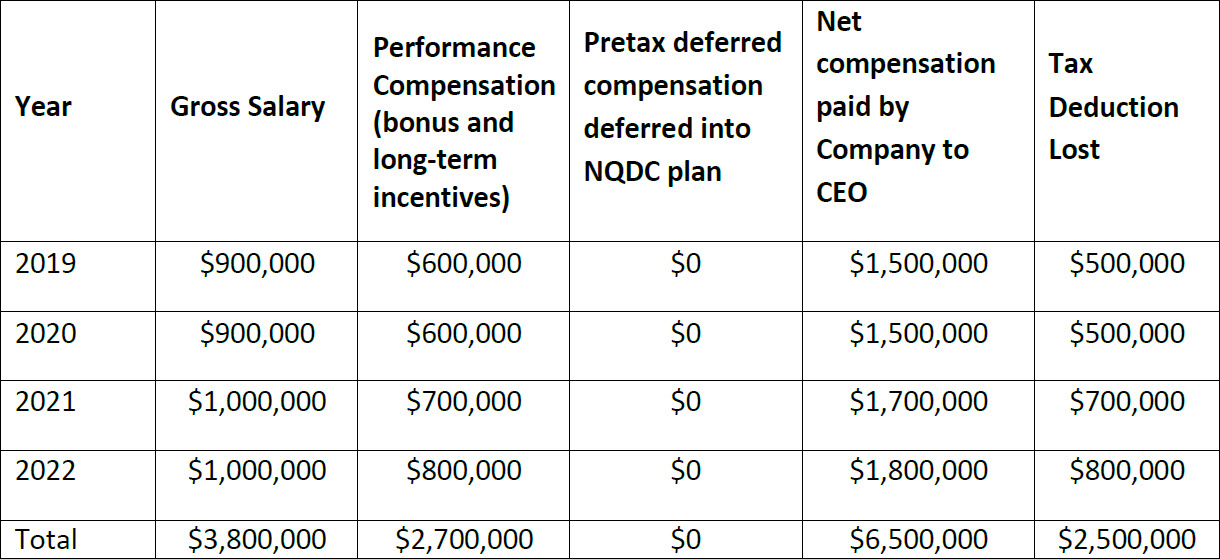

EXAMPLE 1:

Company CEO does not currently defer his/her compensation into the company’s nonqualified deferred compensation plan.

Tax situation of company — CEO does not participate in deferred compensation plan

In this example, the Company (assuming a combined 25% federal plus state effective tax rate) would lose $625,000 ($2,500,000 total deduction with 25% tax reduction) to the bottom line.

Further, the CEO is paying tax at the highest rate in the highest bracket and not saving for retirement.

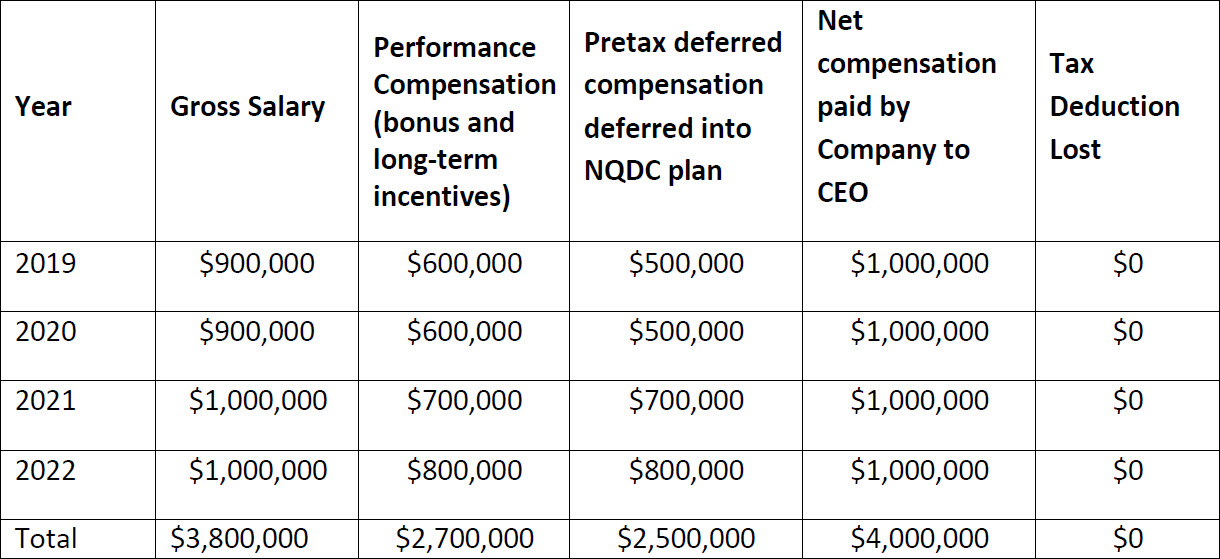

EXAMPLE 2:

Now consider an example when the CEO participates in a deferred compensation plan:

In this example, the Company loses nothing and the CEO has potentially reduced his/her tax bill and will now participate in a tax-efficient retirement savings program. Last, the CEO could elect to receive distributions of the $2.5M (plus earnings) over 10 years which if the CEO had no other income during that time, would likely be taxed at a lower rate than if received during employment. Further, the CEO can elect to receive the income in a state with lower or no state income tax. Note that the deferred amounts are still subject to the 162(m) deduction limit when paid.

The Company can pocket the tax savings or use all or some of it to fund a matching contribution to the deferred compensation plan for the CEO or other participants or to increase their matching contribution to their 401(k) plan for all employees.

So how does the Company accomplish this? Well, first, the Company needs to offer a NQDC plan. Second, executives who qualify as “covered employees” need to be willing to defer compensation. Or, perhaps a better alternative is for the Company to offer part of the Company’s performance-based compensation as a contribution to the NQDC. Such a strategy will accomplish three things:

- Reduce the Company’s current tax bill and potentially allow the Company to increase its contributions to its employees’ retirement plans.

- Allow the Company to emphasize to shareholders that part of the executive group’s performance-based compensation remains subject to the continued and long-term financial well-being of the Company.

- Foster necessary retirement savings for the executive group because Social Security benefits and maximum savings through 401(k) plans will only replace a small portion of executives’ current income.

Either way, the company should consult experienced executive compensation and benefit counsel in deferring any compensation. Failing to follow executive compensation and benefit tax rules can add significant penalties incurred by the executive.

Food for thought on the new tax law!!